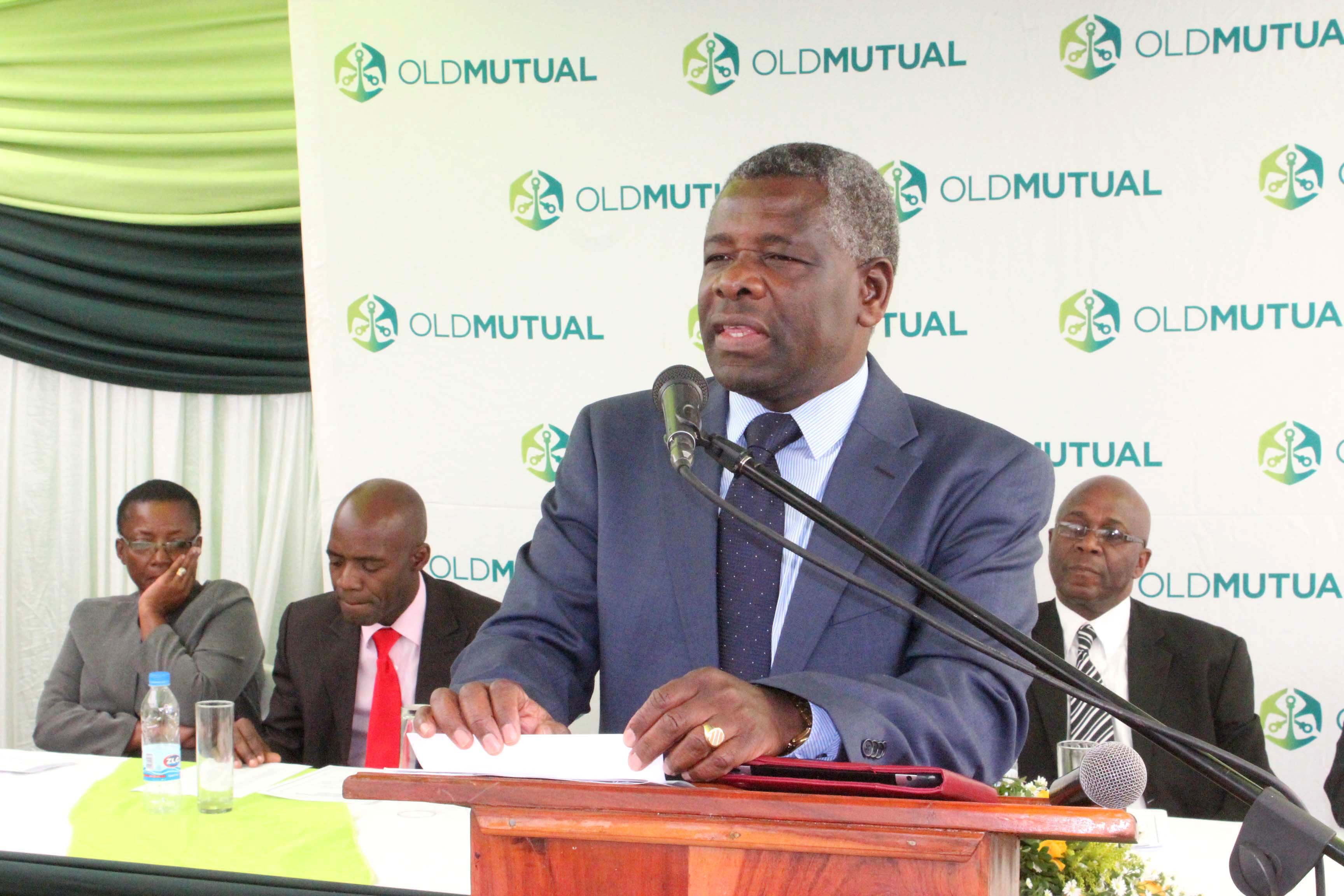

Old Mutual Zimbabwe group deputy CEO Zomunoda Chizura told analysts yesterday that the group will focus on leveraging on strong capital base, solid governance and risk management systems to grow business in FY14.

"We still believe that there is going to be a difficult operating environment where demand is going to be low and liquidity continuing to be quite tight. But we think the changing demographics as well as the changing structure of the Zimbabwean economy presents new opportunities for us to grow business," he said.

Chizura noted that the firm will develop products that are suited to that environment through all of the group companies.

Turning to the financial review, group FD Isiah Mashinya noted that adjusted operating profit for the year ended 31 December 2013 went up by 7% to $64mln while IFRS profit grew by 713% to $122mln.

"What we do in the insurance industry is to smooth out our returns over the long term so we tend to go by an average investment return as opposed to annual returns and that's the reason why the AOP and the IFRS profit are way different," he said.

Premium income was 16% up at $159mln while net client cash flow grew by 9% to $97mln, "a good achievement in such a low liquidity environment," as indicated by Chizura,

Looking at segment contributions to AOP, Mashinya said insurance contributed 56% against 48% in the prior period, banking 29% versus 40%, investment services 11% from 7%.

The group's total revenue improved by 59% to $454.6mln with net earned premiums going up 17% to $148.8mln, investment income rising by 155% to $235.2mln and banking interest and similar income 10% up to $32.7mln on prior year.

"The main reason for this huge growth is the investment returns ($235.2mln) which were realised most of which was driven by the Zimbabwe Stock Exchange performance in 2013," he noted.

Fees, commissions and income from services contracts improved by 6% to $37.4mln.

Under expenses, Mashinya told analysts that net claims and benefits increased by 62% to $240.5mln

In the period under review the group posted a 1 892% growth in profit for the year at $105.6mln. Mashinya said the group's total assets increased by 19% to $1,821.3mln

Moving on the segment performance in the group, the FD indicated that the life insurance business, OMLAC's IFRS profit improved by 68% to $42mln while the gross earned premium went up 3% to $133mln.

He said life sales remained stable at 19% and the business unit holds 53% of the market share, making it the leading life assurance business in the country.

CABS' net interest income improved by 10% to $33mln while loans and advances grew by 16% to $322mln and deposits increased by 30% to $462mln.

"CABS was keeping exceptionally high levels of liquidity last year," he added.

There was credit line growth of 22% to $24mln in CABS while loan book increased by 14% to $322mln. Meanwhile, NPLs were 10.3% against industry average of 15.9%.

"There were deliberate decisions taken in the business to manage non-performing loans and other…considerations," said Mashinya.

RMI posted a 22% growth in gross written premium to $28mln and underwriting result went up 50% to $3mln.

Underwriting ratio closed at 18% from the prior 16% while claims ratio grew by 5% to 45%.

"We think it's a good result as long as claims ratio is being maintained below 50%," he noted.

On the investment services, Chizura stated that there was growth of property portfolio as the group completed the construction of the Borrowdale office park.

He added that "220 housing units were completed in Budiriro Housing project and Phase 1 target is 900 units."

Chizura said 25% of OMZIL is now owned by indigenous Zimbabwean and those shares are trading on the counter (OTC) market which is handled by Old Mutual Securities. He said the OTC was the first step while public listing is a possibility in the near future.

"Even before listing, our disclosures going forward will match that of listed companies," he added.

- zfn

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick