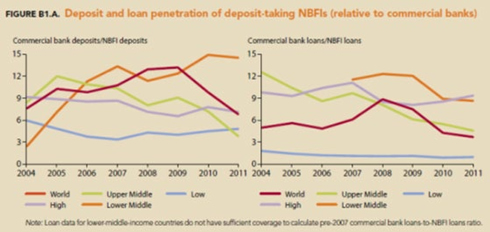

According to the 2012 Financial Access report, there has been a growing importance of Nonbank Financial Intermediaries (NBFI) showing that NBFIs are playing an important role in deposit and loan penetration.

Burundi, for example, reported a larger number of deposit accounts and loan accounts in credit unions than in commercial banks. Based on the latest data available in FAS, the ratio of commercial bank deposit accounts to NBFI deposit accounts started to decline especially after the financial crisis around the world, except for low-income and lower-middle-income countries.

The report showed that the role of NBFIs is even more prominent in loan penetration. NBFI loan penetration increased relative to that of commercial banks everywhere in the world, with the exception of high-income countries.

Total number of deposit-taking NBFIs in the world remained more or less constant, while the total number of commercial banks declined. As of 2011, about half the deposit-taking NBFIs are in high-income countries.

The remaining institutions are divided among upper-middle-, lower- middle-, and low-income countries, at 16 percent, 14 percent, and 20 percent respectively.

The graph above shows the commercial bank loans to NBFI loans ratio and the commercial bank deposits to NBFI ratio for the different income classes of countries.

Zimbabwe is under the low income class. Where we can see that the ratio from 2008 to 2011 in that class has been gradually declining, but the trend is not as significant as it is in the other classes.

The World Bank explains that nonbank financial intermediaries both complement and compete with commercial banks, forcing them to be more efficient and responsive to customers' needs. Especially, pension funds and other institutional investors that mobilise large longterm financial resources can act as countervailing forces to the dominant position of commercial banks.

Tension points in the global economy could affect Sub- Saharan Africa growth Africa's Plus published a report on the economic performance of Africa in the first quarter of the year.

The report showed that Sub- Saharan Africa region has great prospects of growth however the there are some global risks that African economies should be aware of.

The main emphasise of the risks are on the external front, the report stated that a fragile global recovery is a source of risk. Below are the tension points highlighted in the report;

• Tensions in financial markets in the Euro area may have eased since Q2 2012 however conditions remain fragile and sentiment is vulnerable to bad news.

Should they deteriorate markedly, with a credit freeze to some of the larger, high-spread, troubled Euro Area economies, global economy activity could return to recession- like conditions and GDP in Sub-Saharan Africa could fall by up to 3.5 percentage points?

• In an alternate scenario where uncertainty in US fiscal policy leads to increased precautionary savings by US consumers and businesses, US growth could slow by some 2.3 percentage points.

Should that arise, the trade channel alone could cause Sub-Saharan Africa's GDP to decline by 0.6 percentage points relative to the baseline.

Given the importance of the US economy to global markets, the indirect effects through weaker confidence and the rattling of global financial and commodity markets would likely have a stronger impact on the region.

• A third tension point surrounds the possibility of a disorderly unwinding of China's unusually high investment rate.

With Chinese demand accounting for some 50 percent of many industrial metals exported from Africa, a sharper-than envisaged downturn there could lead to a slump in commodity prices which would hurt countries which are especially reliant on oil, metals and other minerals.

- herald

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick