Latest News

Top Story

Concern over Masvingo black market

Concern over Masvingo black market The Zimbabwe National Chamber of Commerce (ZNCC) has castigated the emergence of a black market for some basic commoditi...

Top Story

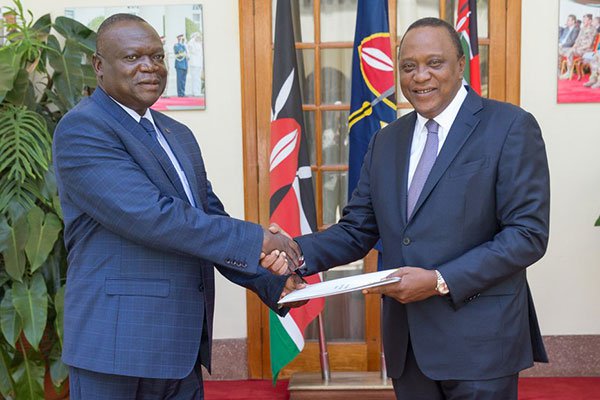

Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe Kenyan President Uhuru Kenyatta declared three days of mourning for the former Zimbabwean President Robert Mugabe on Fri...

Top Story

UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy Boris Johnson has resigned as Foreign Secretary amid a growing political crisis over the UK's Brexit strategy.He is the ...

Top Story

SecZim licences VFEX

SecZim licences VFEX The Securities and Exchange Commission of Zimbabwe has licenced the Victoria Falls Stock Exchange paving way for its sch...

Top Story

Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative The Zimbabwe government has abandoned its plan to access a debt relief facility under the Highly Indebted Poor Countries...

Top Story

European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe The European Investment Bank (EIB) has availed about €40m to Zimbabwe banks within a year, which will go towards baili...

Top Story

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019 Company Name Investec Asset Management Company Location Cape Town, Western Cape, South Africa Click HEREJob descriptionO...

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick