The recent addition of the Chinese currency, among others, into Zimbabwe's much-admired multicurrency system (which the new RBZ governor has already branded as being sin qua non to the Zim economy revival) would have raised eyebrows within the global financial markets in general, and the Zim financial sector in particular.

Admittedly, the Chinese currency is not for the faint hearted, for it has its own bespoke features which can befuddle a credulous investor. The ongoing confusion among currency experts and investors alike relating to the complexity and opacity of the Chinese currency markets bears testimony to the foregoing. Notwithstanding its perceived or misperceived new status as a global financial power and a leading member of the so-called Brics group of countries, it is noteworthy that investments into the Chinese currency markets are still subject to an array of technicalities. These entail tight and stifling regulatory controls, special agreements, restrictions, quotas, and a plethora of other hurdles relating to the convertibility of the currency, acceptability of the currency, liquidity, and challenges faced by financial clearing houses, inter alia.

Against this background, simple questions posed by villagers generally beg for answers: what is it the Chinese currency? Is it a Renminbi or Yuan or CNH? What is its true value?. Is it marked-to-market? Is its value determined by market forces?, or, Is its value determined by the Chinese Communist party or an opaque coterie of politburo members?. These and related questions will continue to be posed by ordinary bread-eating villagers out there. Although China's vigorous intensification of the drive towards internationalization of its currency is now well established, there still remains (within China) a communist inspired propensity to continue tightly controlling the very same currency, thereby diminishing any gains accruing from the globalization of the Renminbi.

As usual whenever discussions of the Chinese currency take place, there is always and everywhere confusion as to what are the real dynamics of this opaque but benign currency. Firstly, there are three issues about the Chinese currency, (i) the Renminbi, (ii) Yuan (CNY) and (iii) the Yuan (CNH). The question which arises is: what are the key differences between and within these three?

To answer these and related questions, one needs to analyse the relationship between the Renmnibi, the Renminbi (CNY) and the Renminbi (CNH).

China's currency is officially called the Renminbi. The Renminbi occurs in two forms, (i) as CNY (what is commonly known as the Yuan), and (ii) as CNH with "H" denoting Hong Kong. Parenthetically, the Renminbi, is thus the name for the currency traded onshore (within mainland China) and offshore (originally through Hong Kong, but now even in Zim). There exists a separation between these two markets. If the Renminbi is traded onshore (in mainland China), it is referred to as CNY, whereas if the Renminbi is traded offshore (.e.g. in Zim) it trades as CNH. Thus, while the Renminbi is just one currency, it trades at two different exchange rates, depending on the location of where the trade occurs, i.e. mainland (in Beijing) or offshore (.e.g. in Zim)

It is worth mentioning that the Renminbi (CNY or CNH) in its capacity as the Chinese medium of exchange and a store of value, carries the full might, faith and credit of the Chinese government. The difference being just the location of where the trade takes place as highlighted above (onshore or off-shore).

An analysis of the two forms of the Renmibi and how they simultaneously trade against the US dollar reveals that the CNY and the CNH are almost perfectly correlated relative to the US dollar. However, notwithstanding the high degree of correlation between the CNY and the CNH, the CNY has generally been slightly weaker (by insignificant points) than the CNH relative to the US dollar. The minor difference (relative to the US dollar) between these two currencies (CNY - CNH) is generally reflective of the liquidity conditions between the onshore and offshore markets with the offshore-traded CNH showing strength derived from its more liquid offshore market.

In conclusion therefore, the fact of the matter is that the Chinese Renminbi is an emerging currency whose government seeks to intensify the process of its internationalization and possibly have it as a future reserve currency (akin to the role of the US dollar) , and, consequently notwithstanding the teething problems associated with its globalisation, the Renminbi must be embraced and used as part and parcel of Zim's fledging multicurrency system.

-----------------

Colls Ndlovu is an independent financial analyst and he writes in his personal capacity.

- Colls Ndlovu

Concern over Masvingo black market

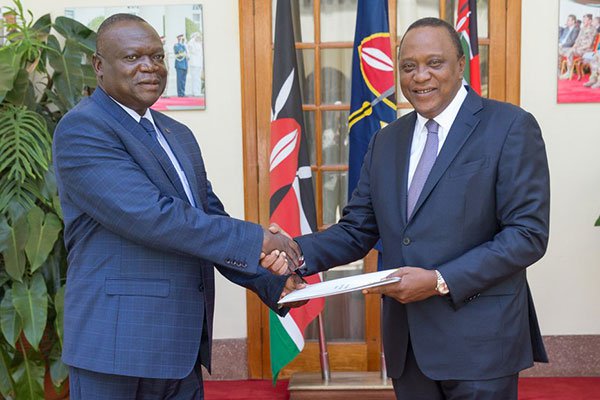

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick