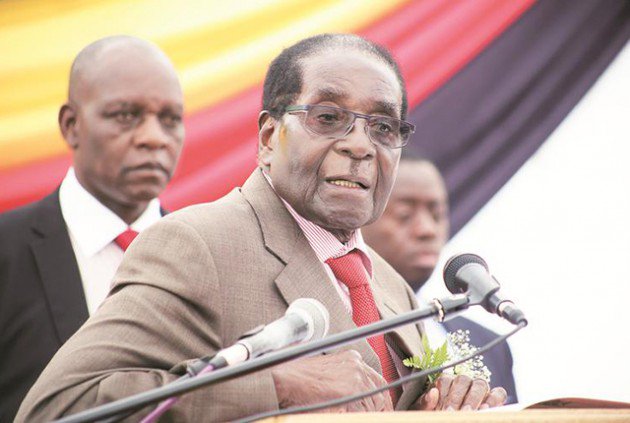

PRESIDENT Robert Mugabe will today meet business leaders to discuss the country's economic emergency, just as retailers warned his government this week of imminent food shortages caused by a worsening foreign currency crisis.

Mugabe, who insists the economy is on the mend, rarely meets business and today's summit presents an opportunity for industrialists to discuss the crisis with the country's chief executive.

Zimbabwe's economy emerged from a decade-long recession in 2009 after Mugabe agreed to share power with the opposition following a disputed 2008 election. After shrinking by as much as 50 percent between 2000 and 2008, the economy expanded by double digits between 2010 and 2012.

Growth has tapered off after Mugabe's re-election in 2013. The economy is expected to grow by 3,7 percent this year, after last year's anaemic 0,7 percent growth.

Much of the country's economic woes are blamed on Mugabe's policies, such as the seizure of white-owned farms to resettle landless blacks at the start of the millennium, the current drive to transfer majority shares in major foreign businesses to locals and government's expansionary fiscal stance.

Confederation of Zimbabwe Industries (CZI) president, Sifelani Jabangwe, confirmed today's meeting with Mugabe, but declined to discuss details.

"I cannot pre-empt what we are going to discuss with the President. This is a once-in-a-lifetime opportunity that we got and we would want to use that time to strengthen our efforts in reviving industry and the economy. We will let you know tomorrow after we have had the meeting," Jabangwe told The Financial Gazette yesterday.

The president last had a similar meeting in 2007 at the peak of a crisis triggered by price controls imposed by government in June that year. Back then, the country's business leadership drew criticism for what critics considered to be a weak response to government's handling of the economy.

The 2007 meeting was defined by a curious apology, contained in a document prepared by business: "We apologise for letting you down as there exists a glaring gap between your goals and our performance as an economy."

Over the past two weeks, bankers, industrialists and retailers have held meetings with the Reserve Bank of Zimbabwe (RBZ) to raise alarm over how the foreign currency crisis was wrecking havoc on their operations.

Miners, manufacturers and retailers, among other key economic sub-sectors, have been struggling to make foreign payments for vital raw materials.

On Tuesday, retailers warned RBZ governor John Mangudya of looming shortages of food and other products which require imported raw materials.

"Empty shelves are not far; very soon they will become the thing given that local manufacturers are also failing to secure forex allocations to import raw materials crucial in the manufacturing process," Confederation of Zimbabwe Retailers (CZR) president, Denford Mutashu, said.

"Furthermore, as retailers, we have lines that need to be imported but have not been getting allocations from the banks to procure them. In this situation, most of us have been forced to buy forex on the black market in order to import these products but there is a problem with that."

Mutashu said retailers sourcing forex on the informal market were paying premiums ranging from 10 percent to as much as 35 percent. The premium is being passed on to consumers, who bear the brunt of resurgent inflation.

Firms struggling to come to terms with fluctuating values of electronic transactions are increasingly changing the terms of businesses using procedures reminiscent of the hyperinflationary period between 2007 and 2008. These include insisting on pre-orders and reducing the validity period of quotations.

Mangudya, however, sought to assure business that the situation would soon improve after the central bank starts drawing down on a fresh $600 million facility with the African Export Import Bank (Afreximbank).

"We are looking for foreign currency to meet some of the challenges and we hope that by mid of this month we will have drawn down the Afreximbank nostro stabilisation facility to meet some of the critical payments that you have given us and we are going to continue exporting our gold and platinum," he said.

The central bank chief added that the foreign payment delays were being compounded by foreign intermediary banks, many of which since ditched Zimbabwean banks.

"We are aware of the delays which are there in the foreign payments, but you also need to know that some of the delays are caused by our correspondent banks. Our intermediary banks are taking their time, sometimes two weeks before they process Zimbabwean payments because we are under sanctions and issues like compliance risks," Mangudya said, adding that the number of corresponding banks to cut ties with local banks had risen from 50 in June.

"We lost about 67 correspondent banking relationships in the world because people are afraid of the Zimbabwean risk. So they call that de-risking, you would think it is a good term, but what they are saying is that they are moving the risk; they are not banking you… removing those accounts that they think might contaminate their books."

The governor said intermediary banks that were still doing business with the country had also intensified compliance checks for Zimbabwean transactions.

"So when they see a Zimbabwean payment, it is red-flagged and they want to know the source of funds and also know the origins of that money and payment beneficiaries in what they call customer due diligence. Even those sending money to Zimbabwe go through the same process and are asked if it is in compliance with the European Union sanctions or OFAC or Zidera," he said.

"It is compliance risk, because they want to avoid any payments of those people who are on sanctions so all of us, by nature, are also subjected to the same treatment. This is how sanctions work, but you hear a normal Zimbabwean saying there are no sanctions, in practice they affect us all."

Economist, John Robertson, said the $600 million facility was not enough to cover the country's foreign payments backlog - officially put at $186 million at the end of May - but estimated at slightly over $1 billion by the market .

"I gather $600 million will not close the backlog given the import priority list which happens to be lengthy at the moment. Before even looking at the list, there will be payments for strategic imports like power and fuel and these will take up much of this fund anyway," he said.

"There is a bubble. On one hand you have worthless money balances floating around being used to pay businesses that need foreign exchange to trade, on the other, you have a thriving black market and a depreciating local currency… It is just a matter of time really and the $600 million facility will not do much in the absence of tobacco sales," Robertson said.

To help manage the flow of foreign exchange after the end of the tobacco selling season, which has generated an annual average $600 million in forex receipts, over the past few years, Mangudya recently directed platinum and chrome miners to surrender 80 percent of their export earnings to the central bank, from 50 percent previously.

"Also along with drawing down the nostro facility, you may recall from my mid-term statement that I asked platinum miners to give us their earnings. They have since started giving us this money, which has made allocations manageable," he said.

Zimbabwe, which adopted the use of a basket of currencies including the United States dollar and South African rand in 2009 to replace its inflation-ravaged local unit, is battling a foreign exchange shortage blamed on diminished local production and the attendant trade deficit.

To manage allocation of scarce foreign currency, the RBZ has drawn up a priority list for foreign payments, while government has imposed an import ban on locally available products.

- Fin Gaz

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick