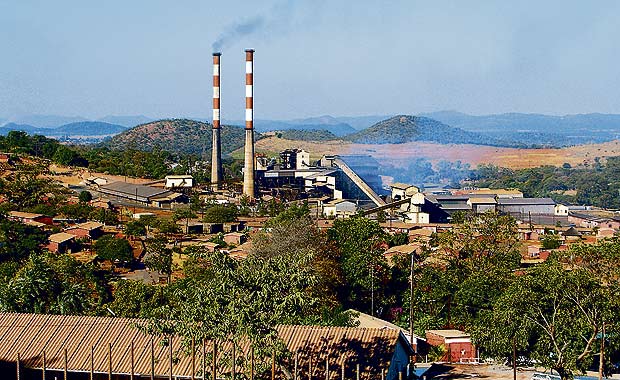

BINDURA Nickel Corporation may now be looking ahead to developing and maximising returns from its Hunters Road resource, smelting and refinery assets after eventually overcoming its financial woes following successful implementation of the nickel miner's revised mining plan for Trojan Mine.

Assuming all things remain equal BNC could now be considered safely out of the woods and far away from the cusp of the financial Sword of Damocles.

Around July this year, BNC raised the red flag warning failure to raise short-term funding and non-implementation of a revised mining plan threatened its future viability. With both short-term funding and revised mining plan for BNC's Trojan Mine now safely in place, it has been an arduous but successful turnaround.

A recent report by Edison Investment Research shows Africa's only integrated smelting and refinery has recorded a faster than expected recovery.

"The improved operational and financial performance at Trojan means the funding requirement at BNC has fallen from an estimated $22 million to circa $5 million currently, which is largely being financed through working capital."

A total of 158 649 tonnes of nickel was mined in the second quarter of 2013 while a total of 154 413 tonnes were milled during the same period against 102 000 and 127 000 tonnes, respectively estimated under the old plan while sales totalled 1 505 tonnes from 604,23 tonnes initially forecast in the original plan. The main challenges faced by Trojan during the BNC second quarter financial period related to equipment availability, which was lower than required owing to the restricted availability of working capital, among other things. In addition to its operational results, on 7 October 2013 BNC reported a resource update at Trojan. Proven and probable reserves increased 27,8 percent to 3,168 tonnes at 1,04 percent nickel, containing 32,975 tonnes nickel.

The nickel resource increased by 2,6 percent, albeit with a 44,8 percent increase in the indicated category, largely converted from inferred an resource.

In the short-term, the adoption of the revised mine plan for Trojan, described in a competent person's review conducted by SRK Consulting of the United Kingdom as realistic and achievable, and the higher profits and cash flows that are arising there from, have allowed BNC to reduce its funding requirement for Trojan from $22 million to $5 million. BNC, a subsidiary of alternative investment market (London) listed Mwana Africa, put assets under care and maintenance at the height of Zimbabwe's economic crisis in 2008, but reopened after recapitalisation in September 2012.

A $21 million rights issue and $2 million private placement allowed the nickel mining company to resume exports under an off take agreement signed with global mineral commodity trader Glencoe International. It also resolved issues around staff numbers and historical debts. But challenges around securing capital to support the second phase of the restart of Trojan Mine threatened the firm's status as a going concern.

"Should the corporation fail to execute the revised production plan, a material uncertainty exists, which may cast significant doubt as to the ability of the corporation and its subsidiaries to continue as a going concern," BNC said.

- herald

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick