Zimbabwe has over the past few years lost 102 correspondent banking relationships due to high country risk, Reserve Bank of Zimbabwe Governor Dr John Mangudya said.

Correspondent banking represents the cornerstone of the global payment system designed to facilitate the settlement of cross border financial transactions. The development has left Zimbabwean financial institutions struggling to access the global financial systems and as a result, many banks are forced to use third parties to transact.

Addressing a lunch hosted by the Swiss Business Circle in Zurich, Switzerland last week, the central bank governor described how Zimbabwe had been shunned by reputable international banks as he appealed for restoration of the critical relationships.

"We need the foreign banks to stop de-risking Zimbabwe," said Dr Mangudya. "The country has gone through de-risking phase over the past 10 years. We have lost 102 correspondent banking relationships because Zimbabwe was seen as a high risk country. "We know it, we suffered it that is why we are saying we are now open for business."

Dr Mangudya was part of the Zimbabwean delegation at the recently held World Economic Forum in Davos where President Mnangagwa told the international investor community that Zimbabwe was open for business. President Mnangagwa also assured potential investors that their investments would be safe under his administration.

Economic analysts said the Government needs to continue pursuing and implementing policies to restore confidence and ensure the country was "seen in positive light".

This is critical because risk is a perception," Oxlink managing director Mr Brains Muchemwa told Business Weekly.

"So Government needs to continue with the efforts to engage the international community and reform regulations and policies (that made investors and foreigners uncomfortable dealing with Zimbabwe) so that the country is seen in positive light.

"If you lose correspondent banking relationships, it becomes difficult to execute international payments.

"It (de-risking) is also aligned with challenges of accessing lines of credit. It is a sign that you have elevated perceived country risk. De-risking means you lose efficiency in international payments."

Muchemwa said the small steps the Government was taking in improving ease of doing business through addressing foreign investors' concerns would go a long way in reducing perceived country risk.

Zimbabwe's high risk profile was also worsened by imposition of sanctions by the west.

For instance, ZB Financial Holdings last year said it managed to regain use of most of its foreign correspondent banking accounts since its removal from the US sanctions list in October 2016. The US Treasury, through its Office of Foreign Assets Control (OFAC) had imposed restrictions on the bank as part of a wider sanctions campaign against Zimbabwe.

A June 2016 International Monetary Fund (IMF) Discussion Note titled 'The Withdrawal of Correspondent Banking Relationships: A Case for Policy Action' highlights the fact that foreign correspondent banking can be lost due to several factors:

"Banks are required to comply with economic and trade sanctions, AML/CFT requirements, and anti-bribery and tax evasion regulations applicable in the jurisdiction(s) in which they operate, as well as with those in their home jurisdictions.

"Compliance with regulatory requirements in these areas involves the implementation of internal controls, including customer due diligence, transaction monitoring, record keeping, and reporting of suspicious transactions. The effective implementation of these procedures may be leading banks to terminate CBRs to comply with targeted financial sanctions, or if there is a reason to believe that the respondent bank is involved in money laundering, terrorist financing, or other fraudulent activities."

- Business Weekly

Concern over Masvingo black market

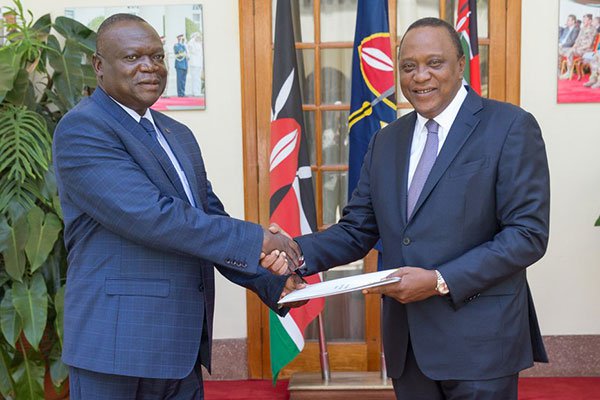

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick