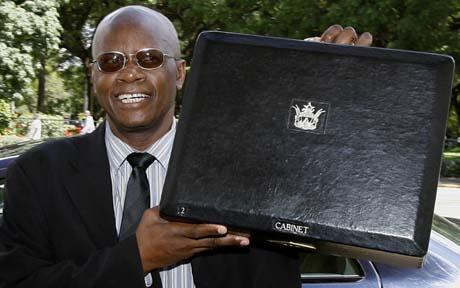

FINANCE Minister, Patrick Chinamasa, said on Thursday the country will stick to an IMF monitoring programme that could pave way for the country to clear its debts, as the economy grapples with chronic power cuts and a crippled manufacturing sector.

Zimbabwe is still emerging from a decade of economic decline and hyperinflation, but the economy is stuttering in the aftermath of a disputed election in July that has extended President Robert Mugabe's 33-year rule.

Harare began an International Monetary Fund-led staff-monitored programme in June which, if successful, could help it clear $10bn in external debts and give it access to new credit from international lenders.

Under the programme, which is set to run until December, it is expected to implement a raft of economic reforms.

"We are committed to the programme," Finance Minister Patrick Chinamasa told Reuters on Thursday.

He said he will travel to Washington this weekend to assure IMF officials there that Harare will continue with programme.

Consumers in the southern African nation have experienced electricity blackouts lasting up to 16 hours a day in recent weeks, which state-owned power utility ZESA attributes to maintenance work on its ageing power generating plants.

Energy and Power Development Minister Dzikamai Mavhaire said this week the only long-term solution to the power crisis was to invest in new plants, which will require billions of dollars and take time to build.

Zimbabwe has a peak demand of 2 200 megawatts of electricity, but only has a supply of 1 167MW, including imports from Mozambique.

The electricity crunch has hit the manufacturing and agriculture sectors, where output has fallen although mines have largely been spared. Zimbabwe has the second-largest platinum reserves in the world after South Africa, as well as one of the biggest diamond deposits and large quantities of coal and gold.

"We are in the intensive care unit," local media quoted Charles Msipa, head of the Confederation of Zimbabwe Industries as saying at the Wednesday launch of a report on the state of manufacturing, which showed many firms were operating at a third of capacity.

"Capacity utilisation is declining, in some accounts by alarming margins, leading to downstream effects like retrenchments and reduced activity on the domestic economy," he said.

Manufacturers are battling with high financing costs, with banks charging as much as 20% interest, and with demands for higher wages from restless workers.

The power cuts have hampered irrigation of the winter wheat crop in a country that a United Nations agency says is facing its worst food shortages in four years.

Mugabe's new government is crafting a new economic policy, but the 89-year old has vowed that all policies will revolve around his plans to force foreign-owned firms to give majority stakes to black citizens.

The policy, known as indigenisation, is seen as discouraging badly needed foreign investment and hindering access to IMF and World Bank funding.

Nevertheless, Zimbabwe's stock exchange continues to recover after the industrial index plunged 11% on Aug 5, the first day of trading after Mugabe's re-election.

The main index rose 14% in September alone in what traders said was a market correction from an overdone sell-off.

Foreign investors are mostly targeting Zimbabwe's largest mobile firm Econet Wireless and SAB Miller's local unit Delta, the two largest firms on the exchange.

"There was initial panic but investors have realised that while the government may not induce the desired economic recovery, there is no additional political risk," a local stock broker said.

- Reuters

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick