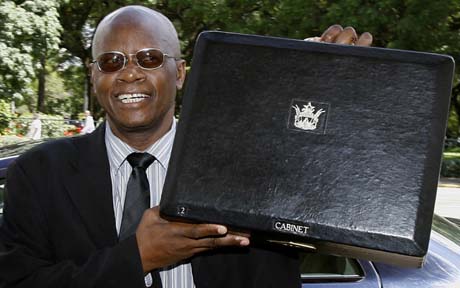

Finance minister Patrick Chinamasa faces a daunting task next month when he presents his maiden national budget for 2014 due to inherent economic challenges in the country.

Market watchers contend Chinamasa - who recently returned empty-handed from Washington, where he failed to persuade the International Monetary Fund to release lines of credit to support recovery - will have to perform a delicate balancing act on Zimbabwe's troubled macroeconomic environment.

The southern African country's economy is currently characterised by a low Gross Domestic Product (GDP) growth rate, untamed fiscal and current account deficits, mounting inflationary burden, decelerated growth, sagging investment and consumption demand and a sluggish global economy.

Zimbabwe's economy, which grew by an average of seven percent between 2009 and 2011 following the establishment of the unity government, began stalling last year due to political uncertainty and constant bickering in government.

Last year, the economy grew by 4,4 percent and is this year expected to grow by 3,4 percent as a result of declining metal prices and drought affecting the country.

In its 2014 outlook, the World Bank forecast Zimbabwe's growth to be around three percent this year with little prospects for a recovery in 2014.

"The economy faces uncertainty both from expected volatility in the global economy, and on the domestic front after the July elections, amidst worsening macroeconomic indicators and increased vulnerability of the banking sector," the bank said.

As Zimbabwe's external position has been supported by substantial short-term capital inflows, the situation would be compounded by the risk of capital outflows from emerging markets, as the United States Federal Reserve progressively unwinds its expansionary monetary policy.

"Growth performance has been stymied by continued slowdown of the key sectors of the economy, amidst easing of international commodity prices, low investment, tight credit conditions, and policy uncertainty after the July elections," the bank said.

This week, Zimbabwe narrowly missed third-quarter budget revenue targets as economic growth slowed and mineral royalties fell, underlining the tough task that Chinamasa faces to lift the economy.

The Zimbabwe Revenue Authority (Zimra) collected $897 million between July and September against a target of $905 million.

The national tax collector said many companies were scaling down operations or had totally shut down.

"The economy continued to face challenges such as erratic power supplies, liquidity constraints, depressed industrial capacity, among other challenges," Stanford Moyo, the Zimra chairman said.

Manufacturers have been the most hit, operating at a third of capacity and battling high financing costs and demands for higher wages from restless workers.

Moyo said company tax collections were three percent short of target and mining royalties were 39 percent below projections, blaming this on fluctuating mineral prices and failure by some diamond mines under Western sanctions to sell their stones.

Economist John Robertson says Zimbabwe's growth prospects are very weak due to government's failure to enunciate policies that attract foreign investment and create a conducive environment for business.

"I do not foresee our economy growing by more than three percent. We need to address the policy discord obtaining in our economy and come up with austerity measures that can boost economic growth," he said.

Robertson noted that government should recognise that there are limitations of revenue-generation and

that the only way out is to create an enabling business environment which allows businesses to flourish.

"At the moment the indigenisation law is debilitating efforts to attract the much-needed foreign direct investment. We hope government will realise a policy shift that will endure the test of time," he said.

Agronomist Peter Gambara argues government must prioritise funding agriculture following an initiative by banks to source offshore funding for the agricultural sector.

"Government should complement these efforts by setting aside some funds in the National Budget that it will be provided to banks for onward lending to farmers," he said.

Agriculture's growth prospects have been revised downwards and the sector is expected to slightly contract by -0,3 percent while the decline in international prices is dampening growth of the mining sector.

"The onus is mainly on government to do the right things at the right time, by paying fertiliser companies their dues so they can manufacture enough fertilisers for the forthcoming season, announcing a pre-planting producer price that will act as an incentive for farmers to grow maize, providing funding on time to banks for on-lending to farmers and channelling free government inputs to the right beneficiaries," said Gambara.

The National Association of Non-Governmental Organisation (Nango) said government must adopt and implement pro-poor policies and programmes in the forthcoming 2014 National Budget in order to improve the standard of living for ordinary citizens.

"68,2 percent of Zimbabwe's households are domiciled in the rural areas and dependent on agriculture for food and income- generation.

Specifically, government must promote property rights by allocating leases that are bankable to allow for sustainable agriculture investment," said Nango.

The association also recommended Chinamasa to prioritise support towards policies which protect and support local industries to stimulate employment creation and ensure policy congruence.

"Government must address the discord that currently exists between the country's indigenisation laws and the need to attract investors and address structural bottlenecks affecting the industrial competitiveness of our local industry," said Nango.

- dailynews

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick