Zimbabwe is among high risk investment destinations in Africa, a survey by Ernst & Young (EY) has revealed.

In its "Africa by numbers: Assessing market attractiveness in Africa" survey, the financial advisory and consultancy firm noted that the southern African country ? still suffering a hangover from a decade-long recession ? is among a group of countries that are "relatively high risk environments and which do not exhibit particularly exciting growth characteristics".

"Logically, these are the obvious markets to say no to, although some may still be worth a closer look or at least keeping on a ‘watch list.' Cameroon and Zimbabwe are good cases in point," said EY.

Out of the 54 African countries, Mauritius tops, underlining its "potential as an investment gateway into the rest of the continent".

EY said neighbouring South Africa stands out not only for its positive risk rating, but also because of the size of the economy and overall market, as well as on-going investments being made in fixed capital assets.

"South Africa provides a stable platform, with strong democratic institutions, a world-class ?nancial and capital markets system, and an environment relatively conducive to doing business," it said.

Zimbabwe's high risk status saw it getting a paltry $400 million in foreign direct investment (FDI) in 2012 when its other neighbours such as Mozambique and South Africa attracted as much as $5,2 billion and $4,6 billion respectively.

It was recently poorly ranked in the World Bank's Ease of Doing Business survey.

In the October 2013 survey the country dropped two places to position 170 out of 189 economies, as few reforms were implemented in the past year.

It also compared poorly to economies like Rwanda which ranked at 32 and is forging ahead implementing necessary reforms to improve its business environment.

Recently, Finance minister Patrick Chinamasa said FDI was critical in funding the Zimbabwe Agenda on Sustainable Socio-Economic Transformation blueprint.

"It is very important that we restructure the financial services sector. It is key for the investment we are talking about," he said.

Market experts say the country is missing opportunities by failing to make the economy competitive to attract much-needed foreign capital as the report is very useful to investors for investment decision-making.

Zimbabwe has failed to redeem itself from a "bad boy" image after President Robert Mugabe began violent seizures of white-owned farms for redistribution to landless blacks in 2000 and successive disputed elections.

In the following years, the former British colony hogged international limelight for its controversial Indigenisation Act which compels all companies to be at least 51 percent locally-owned and a general lack of policy consistency as well as high levels of corruption.

In 2009, the country formed an inclusive government that failed to change perception in terms of doing business with the former government failing to conclude its $750 million iron mining and steel production partnership with Indian firm Essar.

Meanwhile, on the EY risk index benchmark, eight African countries rank above Brazil and India, nine African countries rank ahead of China, and 20 ahead of Russia, according to the findings.

The risk and opportunity matrix within the report highlights four main groups for key stakeholders to rationally assess the pros and cons of different African markets.

The lower risk, higher reward quadrant is the most attractive, offering a stable business environment and high potential for growth.

Ghana is also prominent in this category, with its high economic growth rates, political stability and an environment that is generally conducive to doing business.

Zambia is also emerging as an increasingly attractive market in this category, while the entire East African region is moving rapidlytowards this quadrant.

Michael Lalor, lead partner, Africa Business Centre at EY, said that Africa is increasingly being taken more seriously as an investment and business destination.

"But in many sectors, a window of opportunity does still remain open for establishing an early mover advantage. However, competition is intensifying and that window is closing," he said. For companies and investors looking for long-term sustainable growth, EY is in no doubt that "the time to act on the Africa opportunity is now".

"Now is the time to invest in understanding markets, identifying partners, developing opportunities, configuring industries, building brands and establishing local credibility," said Lalor.

- dailynews

Concern over Masvingo black market

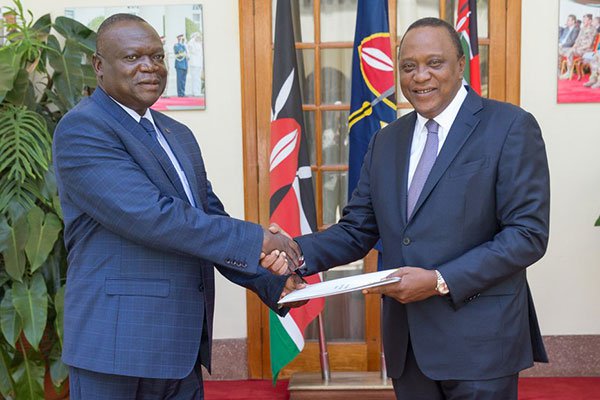

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick